One of the pioneering force in the Indian electric vehicle (EV) market with a focus on Electric two wheelers

(E2W) and Electric three wheelers (E3W) is planning to raise upto Rs. 29.90 crore from its SME public issue. The company has received approval to launch its public issue on BSE SME Platform. The public issue will open for subscription on June 25, 2025 and will close on June 27, 2025. Corporate Makers Capital Ltd is the book running lead manager of the issue.

The initial public offering of Rs. 29.90 crore is entirely a fresh issue of 32,49,600 equity shares for a face value of Rs. 10 each. Price band for the issue is Rs. 87 – Rs. 92 per share. Out o the issue proceeds, company plans to use Rs. 16.50 crore towards funding of working capital requirements, Rs. 3 crore for repayment of portion of certain borrowings and remaining for general corporate purposes and issue

related expenses. Minimum lot size for the application is 1,200 shares which translates into minimum investment of Rs. 1,10,400 at a upper price band of Rs. 92 per share. The retail quota for the issue is 47.51%, NII is 47.47%, QIB is 5.02%, and Market Maker is 5.02%.

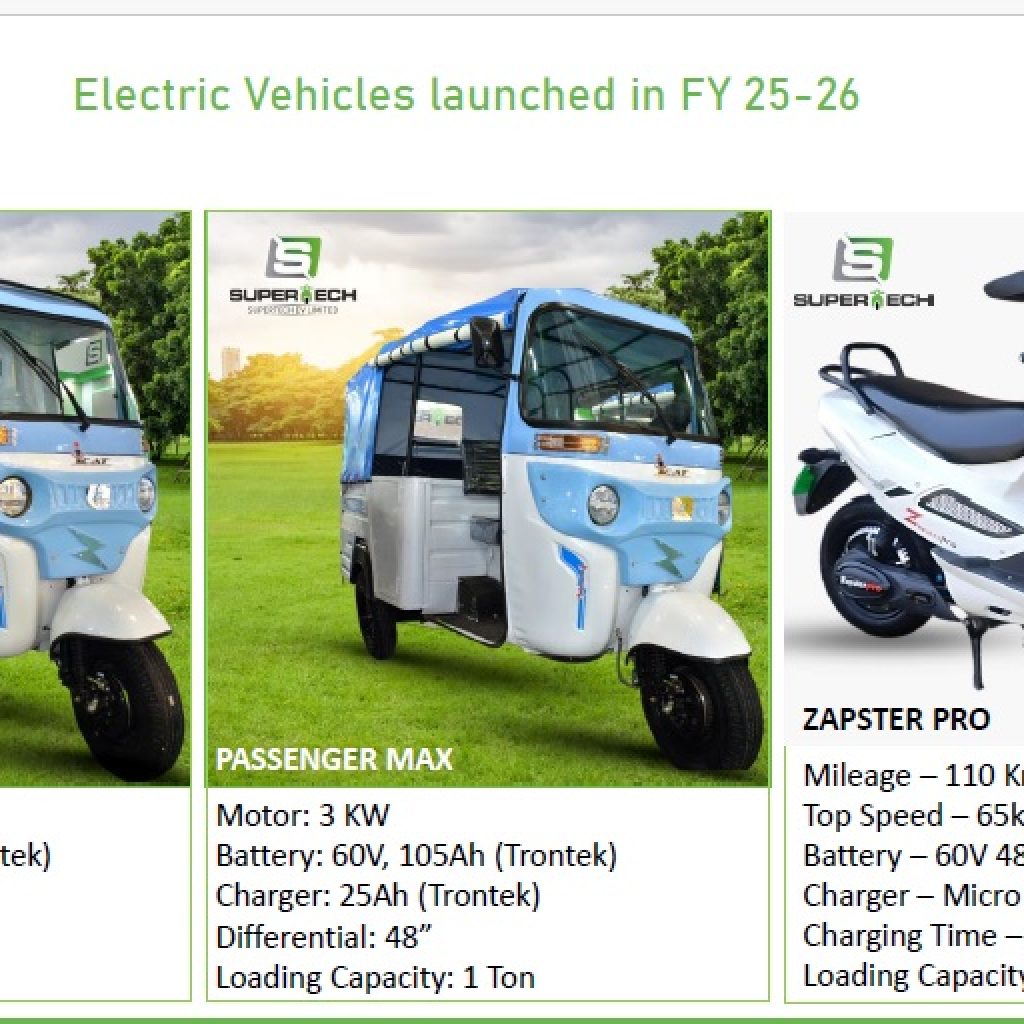

Incorporated in 2022, Supertech EV Ltd is one of the pioneer in the Indian electric vehicle (EV) market. Company offers a wide range of electric two wheelers, three wheelers, garbage disposal vans and loaders catering to diverse needs of the Indian consumer. The company’s product portfolio includes 12 models, comprising 8 variants of electric two-wheelers and 4 variants of E-Rickshaws. Company has built a distribution network of 445 distributors and has a presence across 19 states in India, including Delhi, Haryana, Punjab, Himachal Pradesh, Uttarakhand, Rajasthan, Uttar Pradesh, Gujarat, Madhya Pradesh among others. Company has recently launched products including – Cargo Max, Passenger Max and Zapster Pro in the market in FY 25-26.

India is experiencing a remarkable surge in the sales of electric vehicles, signaling a transformative shift towards sustainable mobility, led by rising subsidies and new launches. In FY 2024, the share of electric two-wheelers was at 5 per cent which is likely to see quantum jump in years to come. Company plans to capitalizing on the burgeoning opportunities in electrification of mobility, aligning our efforts with India’s

vision for a greener future.

For FY24-25 ended on 31 March 2025, the company’s total revenue increased by 17.23% to Rs. 75.19 crore against Rs. 65.14 crore in FY 2024. The company’s net profit rise 23.3% to Rs. 6.19 crore in FY 2025 against Rs. 5.02 crore in FY 2024, with a healthy EBITDA of Rs.9.48 crore in FY25. Net worth and Assets base of the company as on March 2025 stands at Rs. 16.89 crore and Rs. 44.18 crore.

Company has maintained healthy return ratio which as on 31 March 2025 stands follows – Return on Equity and Return on Net Worth stands at 36.66% and Return on Capital Employed at 47.95%.