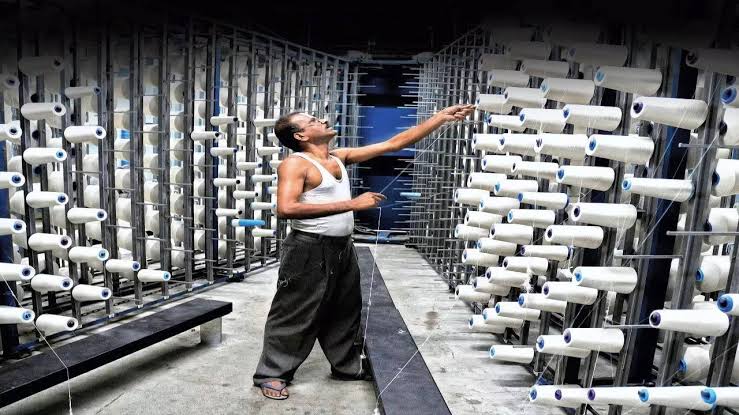

Spinning mills in Gujarat find themselves in the eye of a storm, grappling with surging costs and a shrinking appetite for their products, be it on home turf or in foreign markets. Though cotton prices have eased slightly, they are still perched higher than their international counterparts.

To put it in rupees and candy (356 kg) terms, cotton futures hover between Rs 53,000 and Rs 54,000. This price rift is not just denting the competitiveness of local yarn producers, it is also applying a vice-like grip on their financial stability.

Saurin Parikh, the president of the Spinners’ Association of Gujarat (SAG), sheds light on the situation: “The relatively higher cost of cotton in India compared to other countries is increasing the overall expense of yarn production. As a result, Indian yarn manufacturers face reduced competitiveness in the international market. Furthermore, the ongoing economic downturn in Europe and the US has led to a significant drop in apparel demand due to restrained spending. So, the demand for yarn has failed to rebound. In times of low demand, manufacturers cannot afford to raise prices.”

Even the domestic demand has recently suffered due to reduced discretionary spending, said industry players. Sanjay Jain, chairman of the national textiles committee of the Indian Chamber of Commerce (ICC), said, “The festive season has not brought the expected relief to spinning mills, as demand remains sluggish.

Manufacturers are receiving fewer orders from finished fabric producers. The demand scenario is the worst over the past two decades, with the industry facing a sustained slowdown. Lifestyle alterations and a change in priorities when it comes to purchases are also reasons for the recent decline in discretionary spending.”

The waning demand has also affected the liquidity of the yarn makers. Additionally, SAG’s estimates suggest that the cotton inventory in manufacturing units has been considerably reduced. Parikh revealed inventory days for cotton stock have been reduced from 60 days to just 12 days.

Fisker has reduced the price of its high-end Ocean Extreme SUV in response to a slowdown in demand for electric vehicles and a price war initiated by Tesla. The Ocean Extreme is now 11% cheaper in the US and Canada. Fisker CEO Henrik Fisker stated that it is important for the company to respond to the competitive landscape in the growing EV market. In addition to lowering the price of the Ocean Extreme, Fisker has also increased prices for its lower-end models. Luxury EV maker Lucid Group has also recently launched a cheaper version of its Air Pure sedan to boost demand.

Cotton, soya rates upset farmers

Farmers in Nagpur are disappointed with the opening rates offered for cotton and soybean during the Dussehra muhurat deal. The rates are slightly below the minimum support price (MSP) set for both crops. Additionally, the yellow mosaic virus has affected large tracts of farmland, leading to lower yields. The financial crisis facing farmers has already garnered attention from politicians and activists, with demands for a loan waiver and drought declaration. Traders believe that the actual situation will become clearer as the buying season progresses.

Demand for BArch courses on the wane in Karnataka

The demand for architecture courses in Karnataka has been declining in recent years, with many seats going unfilled. Reasons for the poor response include an oversupply of colleges but a lack of job opportunities, low entry-level salaries, and high course fees. The increase in private colleges has also led to exorbitant expenses for students. Additionally, confusion surrounding the National Aptitude Test in Architecture (NATA) has contributed to the decline in interest. Academicians and faculty members believe that the current situation may have a negative impact on colleges offering architecture courses.