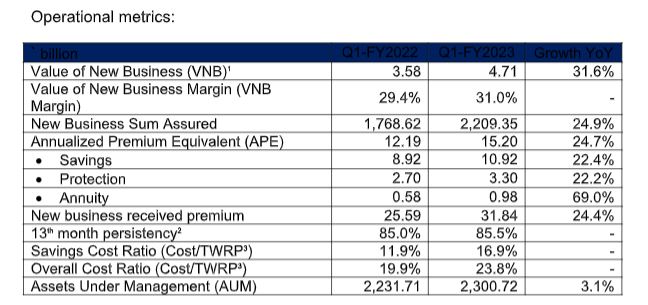

ICICI Prudential Life Insurance has posted a strong financial performance for Q1-FY2023 registering a 31.6% growth in its Value of New Business (VNB), a measure of profitability of the Company. The VNB of the Company stood at ` 4.71 billion with a VNB margin of 31.0%.

Annualised Premium Equivalent (APE) registered a strong growth of 24.7% year-on-year. The Company’s New Business Sum Assured grew by 24.9% year-on-year to ` 2.21 trillion in Q1-FY2023.

Significantly, the Company has achieved overall market leadership with the market share increasing from 14.7% in Q1-FY2022 to 15.8% in Q1-FY2023. Persistency ratios have improved across all cohorts. The 13 th month ratio, which is representative of the quality of business, stood at 85.5% for Q1-FY2023.

Mr. N S Kannan, MD&CEO, ICICI Prudential Life Insurance said, “The VNB for the quarter was ` 4.71 billion, a strong year-on-year growth of 31.6%. This was driven by a robust 24.7% growth in APE. Guided by the elements of our 4P strategy of Premium growth, Protection focus, Persistency improvement and Productivity enhancement, we believe we are on track to achieve our aspiration of doubling the FY2019 VNB in this fiscal.

Significantly, our efforts to reach out to the underserved customer segments and expansion in the distribution footprint have enabled us to maintain our position as market leader on New Business Sum Assured, which grew by 25% year-on-year in Q1-FY2023, taking the Company’s market share to 15.8% in Q1-FY2023. With a solvency ratio of 203.6%, which is well above the regulatory requirement, we are well positioned to capitalise on this opportunity.

With a moderating trend in COVID-19 related claims, we expect the country to be in the tail end of the pandemic. The pandemic was a trying time for all and it also nudged us closer to our very purpose of existence – providing financial security to our customers and their families. I can proudly say that we rose to the occasion and stood by our customers in their hour of need. The path-breaking reforms introduced by the Regulator to increase penetration will usher in a sustainable growth for the industry going forward.”

Company Performance:

Value of New Business (VNB) growth

The VNB for Q1-FY2023 grew by 31.6% year-on-year to ` 4.71 billion. The VNB margin for Q1-FY2023 stood at 31.0%, up from 28.0% for FY2022.

Progress on our 4P strategy

Premium Growth APE grew by 24.7% year-on-year to ` 15.20 billion in Q1-FY2023. Within this, annuity APE registered a strong growth of 69.0% year-on-year to ` 0.98 billion in Q1-FY2023.

Protection

Protection APE grew by 22.2% year-on-year to ` 3.30 billion in Q1-FY2023. The protection mix stood at 21.7% of APE in Q1-FY2023, up from 17.0% in FY2022.

As a result of the focus on premium growth and protection business, New Business Sum Assured grew by 24.9% year-on-year to ` 2.21 trillion in Q1-FY2023. The Company’s market share, based on Total New Business Sum Assured, increased from 13.4% in FY2022 to 15.8% in Q1-FY2023, resulting in overall market leadership.

Persistency ratios have improved across all cohorts. The 13 th month ratio, which is representative of the quality of business stood at 85.5% for Q1-FY2023. Assets under Management stood at ` 2,300.72 billion at June 30, 2022.

Productivity

The overall cost ratio i.e. Cost/Total Weighted Received Premium (TWRP) stood at 23.8% in Q1-FY2023. The cost ratio for the savings line of business stood at 16.9% in Q1-FY2023. Solvency Ratio

The solvency ratio was 203.6% against the regulatory requirement of 150%.

Definitions, abbreviations and explanatory notes

- Annual Premium Equivalent (APE): APE is a measure of new business written by a life insurance company. It is computed as the sum of annualised first year premiums on regular premium policies, and ten percent of single premiums, written by the Company during any period from new retail and group customers.

- Value of New Business (VNB) and VNB margin: VNB is used to measure profitability of the new business written in a period. It is present value of all future profits to shareholders measured at the time of writing of the new business contract. Future profits are computed on the basis of long term assumptions which are reviewed annually. VNB is also referred to as NBP (new business profit). VNB margin is computed as VNB for the period/APE for the period. It is similar to profit margin for any other business.

- Persistency: It is the most common parameter for quality of business representing the percentage of retail policies (where premiums are expected) that continue paying premiums. Regular and Limited pay persistency in accordance with IRDAI circular on ‘Public Disclosures by Insurers’ dated September 30, 2021.

- Total Weighted Received Premium (TWRP): TWRP is a measure of total premiums from new and existing retail and group customers received in a period. It is sum of first year and renewal premiums on regular premium policies and ten percent of single premiums received from both retail and group customers by Company during the period.

- Cost Ratio: Cost ratio is a measure of the cost efficiency of a Company. Expenses are incurred by the Company on new business as well as renewal premiums. Cost ratio is computed as a ratio of all expenses incurred in a period comprising commission, operating expenses, provision for doubtful debts and bad debts written off to total weighted received premium (TWRP).